Fund With no Credit score assessment Doing $5,one hundred thousand

Many other on the web no credit score assessment financing only provide restricted finance, but we all know that the possibly isn’t enough to help you resolve your own troubles. That’s why you can expect funds up to $5,one hundred thousand, getting sufficient money to fund the main things in life.

The amount of money you will end up acknowledged to possess is dependent upon the application, however when weighed against other financial institutions, you can expect way more independence.

Zero Credit check Cash advance Having Protected Recognition Compliment of Slick Bucks Financing

emergency loans no credit check direct lender

No financial offers a hundred% ensure, therefore in search of zero credit score assessment fund that have guaranteed recognition is nearly impossible. Nevertheless, particular lenders are notable for highest approval prices and don’t do difficult borrowing from the bank checks for their payday loans.

Almost every other loan providers leave you waiting days if you don’t months getting approval, however, we all know that point is extremely important. When you yourself have an unexpected expense, often simply take care of it instantly, and you also can not afford to go to.

In the Slick Cash advance, the net loan procedure works fast, for getting the loan best when you need it. Once you have come accepted, you will see entry to your loans right away.

Why do Lenders Check Borrowing from the bank?

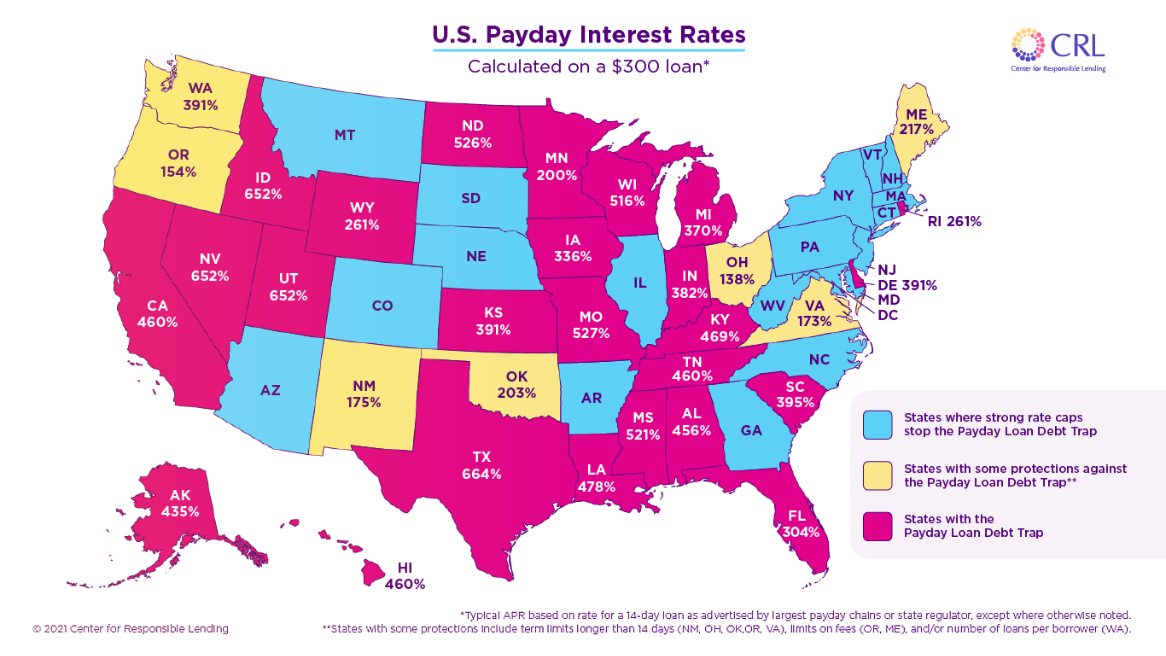

A credit check is vital for loan providers seeking stop defaulters. All of the loan you acquire, and additionally student loans, handmade cards debts, and domestic mortgages, are filed. Consequently, you can easily build a stronger credit score once you pay-off the mortgage as required of the the conditions.

For folks who default or build later payments, you’ll experience penalties and you may a less than perfect credit rating. Loan providers do borrowing from the bank inspections to evaluate the risk of loaning a great particular client.

Borrowing inspections allow it to be lenders to choose if you be eligible for an effective loan device and you can precisely what the terms should be. Individuals with a good FICO credit score gets highest mortgage limits and lower attract. People who have mediocre credit will get straight down fund with more attract.

When you have a score lower than 580, you may want to not be able to get any loan once the traditional loan providers acknowledge individuals which have poor credit given that untrustworthy. Yet not, you could still qualify for zero credit check factors.

Advanced Cash loan Has the benefit of Money For those who have No Borrowing

Men and women can make economic errors inside their existence, but unfortunately, often those people problems is restriction you later. We know that credit is not always a reflection of the responsibility as a person, which is why we offer zero credit check money in regards to our customers. This makes this new acceptance processes smaller. You’ll not need to bother about difficult questions that may drive your credit rating off even more.

Change your Credit history Having Monthly obligations

For folks with poor credit recommendations, applying for numerous loans can drop-off the credit score then, while the fico scores will suffer when they discover several credit checks into the a small amount of day.

This can trap somebody demanding financing, because they’re stuck being unable to safe that loan due to their credit history, that is always decreasing. Trying to get an online mortgage that doesn’t require a credit assessment brings some one using this pitfall. Likewise, whether your borrower helps make the concurred mortgage costs on time, their credit score commonly increase.

No Credit check Financing Conditions

Typically, an individual with little if any credit score are a suitable loan applicant when they satisfy the after the standards:

- Is actually 18 ages or above in the ages

- Provides a permanent All of us address and they are a beneficial Us resident

- Offer good contact info, such as for instance a mobile amount

- Currently employed that have a stable monthly earnings